Old National Bank, Evansville, IN (Charter 12444)

Old National Bank, Evansville, IN (Chartered 1923 - Closed (Merger) 1999)

Town History

Evansville is a city in Vanderburgh County, Indiana, and its county seat. With a population of 118,414 at the 2020 census, it is Indiana's 3rd-most populous city after Indianapolis and Fort Wayne, the most populous city in Southern Indiana, and the 249th-most populous city in the United States. It is the central city of the Evansville metropolitan area, a hub of commercial, medical, and cultural activity of southwestern Indiana and the Illinois–Indiana–Kentucky tri-state area, which is home to over 911,000 people. The 38th parallel north crosses the north side of the city and is marked on Interstate 69 immediately north of its junction with Indiana 62 within the city's east side.

Situated on an oxbow in the Ohio River, the city is often referred to as the "Crescent Valley" or "River City". Early French explorers named it La Belle Rivière ("The Beautiful River"). The area has been inhabited by various indigenous cultures for millennia, dating back at least 10,000 years. Angel Mounds was a permanent settlement of the Mississippian culture from AD 1000 to around 1400. The city of Evansville was founded in 1812.

Evansville had 13 National Banks chartered during the Bank Note Era, and all 13 of those banks issued National Bank Notes.

Bank History

- Organized August 14, 1923

- Chartered September 29, 1923

- Succeeded 7478 and assumed its circulation (Old State National Bank, Evansville, IN)

- Bank was Open past 1935

- For Bank History after 1935 see FDIC Bank History website

- Merged into Old National Bank, Lawrenceville, IL, November 5, 1999

On June 27, 1923, stockholders of the Old State National Bank voted that the bank liquidate its affairs on Saturday, September 29, 1923. Ninety per cent of the total stock of the bank was represented at the meeting and the vote was unanimous in favor of liquidation. S.L. Orr, M.S. Sonntag and Louis A. Daus were selected by the stockholders as a liquidating committee. H.J. Reimer was made secretary of the committee. An application for the organization of a new national bank, to begin business on Monday, October 1, 1923, with a paid-in capital of $500,000, and $100,000 surplus, was signed and forwarded to the treasury department at Washington. The signers were: W.H. McCurdy, president, Hercules Corporation and president of The Old State National Bank; M.S. Sonntag, president American Trust and Savings Bank; James T. Walker, attorney-at-law, vice president and trustee of Peoples Savings Bank; Sidney L. Ichenhauser, secretary and treasurer of the Ichenhauser Company and director of The American Trust and Savings Bank; S.L. Orr, president of the Orr Iron Company; F.R. Wilson, vice president of the Old State National Bank; Henry C. Kleymeyer, president, Standard Brick Company; Louis A. Daus, president Anchor Supply Company; G.A. Trimble, vice president of the Vulcan Plow Company; J.O. Davis, vice president and cashier of The Old State National Bank; John L. Igleheart, vice president, Igleheart Brothers; H.D. Bourland, president, Red Spot Paint and Varnish Company; H.J. Reimer and A.F. Bader. These men were all current officers and directors of The Old State National Bank of Evansville, and would constitute the officers and directors of the new national bank. The name of the new bank, while not yet definitely settled, was thought to be The Old National Bank of Evansville. At the close of business on Saturday, September 29, officers would have from Saturday noon until Monday morning to effect a physical transfer of the assets from the Old State National Bank to the new institution.[5] This was the fourth time the bank was reorganized since it came into existence. The stockholders enjoyed a dividend of 200% as part of the liquidation proceedings voted by the directors who also established a defense fund of $100,000. The new charter extended the life of the bank over a period of 99 years.[6] The bank's officers were W.H. McCurdy, president; F.R. Wilson, vice president; J.O. Davis, vice president and cashier; H.J. Reimer and A.F. Bader, assistant cashiers; and O.F. Lamble, auditor.[7]

The story of the Old National Bank in Evansville dated back to the establishment of the State Bank of Indiana in 1834. The bank was then located at the south corner of Main and Water Streets, later the site of the Richmond Hotel. Later a banking building was erected just a half block away on Main Street that stood for years as the center of the commercial life of Evansville.[8]

In October 1927, the planned building improvements costing $60,000 would add one additional story and alterations to two other stories, increasing the office capacity by 40 rooms, giving the building a total of 112 offices and 12 stores, according to A.F. Bader, building manager. Construction included a new roof, installation of new elevators, electrical lighting, pumping system, and rebuilding the storage vault in the basement. Alfred E. Neucks, architect was preparing plans and specifications for contractors' bids.[9]

On February 5, 1935, Frank R. Wilson succumbed to heart disease at his Evansville home. He was recognized as one of the financial leaders of the city, having figured prominently in the development of industry along with his banking duties. He was the son of Samuel F. and Margaret Reed Wilson, pioneer settlers of Neoga, Illinois, where he was born June 19, 1878. After receiving his early education there, Mr. Wilson went to Wabash College at Crawfordsville, Indiana. Three years after graduation he started his banking career as a clerk in the Cumberland County National Bank of Neoga, of which his father was president. Four years later he took a position in the Shelby Bank at Shelbyville, Indiana, which he reorganized later into the Shelby National Bank. In May 1911, Mr. Wilson came to Evansville as cashier of the Old State National Bank. Three years later he resigned to become secretary and treasurer of the old Hercules Buggy Corporation. He was a close friend of Colonel W.H. McCurdy who founded the company and also was head of the bank at that time. In 1916, Mr. Wilson returned to the Old State National Bank as vice president and director. He also was on the board of the Morris Plan Company which was later merged as the Central Union Bank. When the Old State National Bank was reorganized as the Old National Bank, Mr. Wilson was one of the active executives in the change. Mr. Wilson was one of the leaders in the reorganization of the Hercules Corporation into the Servel Manufacturing Company and served as receiver for that concern until it became Servel, Inc.[10]

On Wednesday, June 5, 1935, directors announced that Robert D. Mathias was elected vice president, succeeding the late Frank R. Wilson. Mr. Mathias resigned as executive vice president of the First National Bank of Elkhart, having joined this bank in September 1932, and would assume his new duties around June 24th. Mr. Mathias was born in Kansas City May 15, 1897, and was a former star football player and a World War veteran. He was a member of the famous "Praying Colonels" team at Centre College, Danville, Kentucky, that won a Southern Conference championship. He also attended Rice Institute. He enlisted in the U.S. Naval Aviation Corps in 1917 and served until the end of the war, being discharged as chief quartermaster in 1918.[11]

On Wednesday, January 10, 1940, Robert D. Mathias, former executive vice president, was elected president of the Old National Bank, succeeding Samuel L. Orr who was made chairman of the board. Other officers were re-elected including Lewis R. Elkins, vice president; Oscar E. Lamble, cashier; O.H. Eberhart, Elmer V. Belzer, Fred C. Newman, assistant cashiers; and L.A. Lundquist, trust officer. Mr. Orr, president of the bank since 1931, requested that he not be considered for re-elections. The retiring president was a grandson of one of the bank's early presidents and represented the third generation of his family to be connected with the institution. For almost 85 of the bank's 105 years, a member of the Orr family had been an officer or director. Mr. Mathias was the bank's twelfth president since its founding in 1834. They were in order John Mitchell, Samuel Orr, George W. Rathbone, William J. Lowry, Samuel Bayard, Captain John Gilbert, Robert K. Dunkerson, Henry Reis, William H. McCurdy, John L. Igleheart, and Samuel L. Orr.[12]

On July 28, 1948, William A. Carson, for four decades identified with industry, finance and civic affairs in Evansville, was elected president of the Old National Bank. At the same time directors accepted the resignation of Lewis R. Elkins as vice president of the bank. Mr. Carson succeeded Robert D. Mathias who left July 3rd to become president of the recently formed Chicago National Bank. The announcement of Mr. Carson's election was made by Thomas J. Morton, Jr., chairman of the bank's executive committee.[13]

On Monday, July 10, 1950, a special meeting of stockholders was held at the banking house at No. 416 Main Street to vote on a plan to consolidate the Old National Bank with The North Side Bank located in the City of Evansville. Walter A. Schlechte was the executive vice president.[15] Stockholders approved the merger and on Monday, August 28, 1950, the North Side Bank became the North Side Office of the Old National Bank. Mr. Herman J. Folke would continue as the active officer in charge of the North Side Office at 100 North Main Street.[16]

On Friday, January 5, 1951, an open house was held for the new East Side office of the Old National Bank. A presentation of the official certificate from the comptroller of the currency for the operation of the new office was made by Walter A. Schlechte, executive vice president, to William C. Raney, manager.[17] Stockholders would meet on March 19, 1951, to consider the agreement to consolidate with the Franklin Bank and Trust Company located at No. 2121 W. Franklin Street in Evansville. The agreement had been executed by a majority of the directors of the Old National Bank and the board of Franklin Bank and Trust Company. Charles O. Wesselman was president of the trust company.[18]

Stockholders of both institutions approved the merger which would become effective May 1st, subject to approval by supervisory authorities. The merger was begun the previous year and at the time, Citizens National Bank also sought consolidation with Franklin, but Citizens later dropped out of the picture. Walter A. Schlechte said that "Bringing the Franklin bank into the Old National organization follows the policy inaugurated more than a year ago to extend the services of our bank to every section of the city. As Evansville continues to grow, a single down-town location for a bank does not fully meet the requirements of customers in the widely separated sections of the city. This consolidation will help everybody. Franklin customers will continue to deal with their same friends in a location well-known to them and at the same time have a much broader and stronger banking facilities at their disposal." Franklin bank as of December 31, 1950, reported resources of $6,937,000. Old National's resources on that date totaled $60,300,000.[19]

On Tuesday, January 20, 1953, at the annual stockholders and directors meeting, William A. Carson was moved up from president to chairman of the Old National Bank. He was succeeded as president by Walter A. Schlechte, former executive vice president. Bank officials emphasized Mr. Carson was bank chairman, a new title, rather than chairman of the board. This meant he would continue as an active officer of the bank rather than becoming presiding officer of the board. Mr. Carson had been an Evansville resident since 1908 and a member of the bank's board since 1935. He came to Evansville as manager of the Evansville Railways Company, later he became E. & O.V. Railway president and headed the Sunbeam Electric Manufacturing Company which was sold to Seeger Refrigerator Co. Mr. Schlechte had almost 25 years experience in banking coming to Evansville in 1948 from Petoskey, Michigan, where he was cashier and director of the First State Bank. Directors also advanced Melburn G. Berges and John D. Clark, Jr. to vice presidents; Miss Bunner Maier as assistant trust officer; and Clarence Maasberg, in charge of loans and collections since 1945, as assistant cashier. Miss Maier had been with the bank since 1945 and Mr. Maasberg since 1910. All the banks officers and directors were re-elected.[20]

In December 1985, two banks in Evansville and Terre Haute announced an agreement to merge in expectation that the General Assembly would approve multi-bank holding companies in the coming year. Old National Bank of Evansville agreed to buy the stock of Merchants National Bank in Terre Haute for about $25 million if and when the legislature makes such transactions legal.[22]

In February 1985, a bank reform bill before the Indiana State Senate would allow Indiana banks to expand beyond the borders of their home county. It also would allow Indiana banks to buy banks in any neighboring state that had reciprocal laws allowing banks in those states to buy Indiana banks. Kentucky was the only state with such a law. Kentucky banks had not been able to grow outside their state because none of Kentucky's neighbors allowed cross-state banking. Richard Schlottman, president of the Old National Bank n Evansville said, "The odd part of this issue is that no one knows whether they will take over or be taken over. Even the banks in Louisville are not exempt from that uncertainty." Charles Phillips, executive vice president of First Midwest Bank and Trust in New Albany said, "If the major Louisville banks are doing their strategic planning, which they are, they're certainly looking carefully at Indiana, particularly the Southern Indiana market they are familiar with." First Midwest was created by the merger of The Floyd County Bank and Union Bank and Trust of New Albany, Indiana.[23] In June 1985, Old National's chairman, Dan Mitchell, said the bank had plans to acquire Southern Indiana Bank and Trust, a Newburgh bank with assets of $11 million when cross-county banking became legal on July 1st. Other acquisitions planned included the Merchants National Bank of Terre Haute and First Citizens Bank and Trust of Greencastle.[24] The new law prohibited a holding company from controlling more than 10% of the state's deposits. That figure would rise to 11% on July 1, 1986 and 12% on July 1, 1987. American Fletcher Corp., the state's largest holding company, controlled about 7.8% of Indiana's deposits. As a result, Frank E. McKinney, Jr., the company's chief executive, side "the number of acquisitions may not be that large... We're going to be selective where we go in the state." The new law also would enable banks to establish branches in neighboring counties, but the section restricted banks of more than $400 million in assets in setting up two branches in the next five years. Smaller banks would have an easier time. Those under $200 million could establish one branch each fiscal year through June 30, 1990. The net effect according to officials would be the buying of other banks as the primary method to expand.[25] The Report of Condition for the year ending 1984 for the Old National Bank showed total assets of $724,232,000, with capital stock, surplus and undivided profits of $59,222,000 and deposits of $566,692,000.[26]

In November 1985, in its first earnings report since becoming a multi-bank holding company, Old National Bankcorp reported a 9% increase in net income for the third quarter. The holding company which owned the Old National Bank in Evansville and Merchants National Bank in Terre Haute made $3.16 million or $1.44 a share in the three months ending September 30th. Total assets of the holding company were $949.76 million with most of the growth coming in real estate loans. Old National's cred card division also had a 28% increase in business during the quarter, according to Dan Mitchell, chairman of Old National.[27] Additionally, application was made to the Comptroller of the Currency for consent to the merger of Southern Indiana Bank and Trust Company, Newburgh, Indiana, and Old National Bank in Evansville. It was planned for all offices of the banks to continue to operate as branches of Old National.[28]

In January 1986, Old National Bancorp's aggressive expansion continued with the announcement it would acquire Rockville National Bank for about $9 million. The newest acquisition located northeast of Terre Haute in Parke County, Indiana, would be part of a cluster of banks Old National had purchased in the Terre Haute area. The lead bank was Merchants National Bank of Terre Haute which was Old National's first acquisition. According to Mike Hinton, vice president and marketing director at Old National, Rockville National with assets of about $46 million would retain its name, management and board of directors. The bank also had a branch office in Montezuma, Indiana. Much of Rockville National's stock was owned by the family of bank president Norval Dixon, a fourth generation official of the bank. His wife's grandfather and father both served as president of the bank, and various other ancestors had run it since it was founded in 1855. Rockville National would join First Citizens Bank & Trust of Greencastle, Indiana, in the cluster headed by Merchants National. Old National was also acquiring Southern Indiana Bank & Trust in Newburgh and Peoples Bank & Trust in Mount Vernon, Indiana. Those banks would become part of a cluster headed by Old National in Evansville.[29]

- 02/28/1986 Acquired Southern Indiana Bank and Trust Company (FDIC #22175) in Newburgh, IN.

- 12/13/1990 Acquired Warrick National Bank (FDIC #14568) in Boonville, IN.

- 10/25/1996 Acquired Gibson County Bank (FDIC #8050) in Princeton, IN.

- 10/17/1997 Acquired People's Bank and Trust Company (FDIC #12852) in Mount Vernon, IN.

- 04/17/1998 Acquired The National Bank of Carmi (FDIC #3778) in Carmi, IL.

- 10/23/1998 Acquired The Citizens National Bank of Tell City (Charter 7375) (FDIC #4411) in Tell City, IN.

- 10/23/1998 Acquired Security Bank and Trust Co. (FDIC #15433) in Mount Carmel, IL.

- 12/11/1998 Acquired Farmers Bank, National Association (FDIC #12147) in Owensboro, KY.

- 09/09/1999 Acquired The Merchants National Bank of Terre Haute (FDIC #12849) in Terre Haute, IN.

- 09/09/1999 Acquired Dubois County Bank (FDIC #11757) in Jasper, IN.

- 10/07/1999 Acquired Security Bank & Trust Co. (FDIC #15571) in Vincennes, IN.

- 10/07/1999 Acquired Morganfield National Bank (FDIC #2760) in Morganfield, KY.

- 10/07/1999 Acquired Farmers Bank and Trust Company of Madisonville (FDIC #2758) in Madisonville, KY.

- 10/07/1999 Acquired First State Bank (FDIC #2747) in Greenville, KY.

- 10/07/1999 Acquired The City National Bank of Fulton (FDIC #2744) in Fulton, KY.

- 11/04/1999 Changed Institution Name to Old National Bank.

- 11/04/1999 Acquired The First National Bank of Oblong (FDIC #3824) in Oblong, IL.

- 11/04/1999 Acquired United Southwest Bank (FDIC #10099) in Washington, IN.

- 11/04/1999 Acquired The First National Bank of Harrisburg (FDIC #3800) in Harrisburg, IL.

- 11/04/1999 Acquired Palmer-American National Bank of Danville (FDIC #3646) in Danville, IL.

- 11/04/1999 Acquired First-Citizens Bank and Trust Company (FDIC #9091) in Greencastle, IN.

- 11/04/1999 Acquired Bank of Western Indiana (FDIC #12838) in Covington, IN.

- 11/05/1999 Merged and became part of Old National Bank (FDIC #3832) in Lawrenceville, IL.

Official Bank Title

1: Old National Bank in Evansville, IN

Bank Note Types Issued

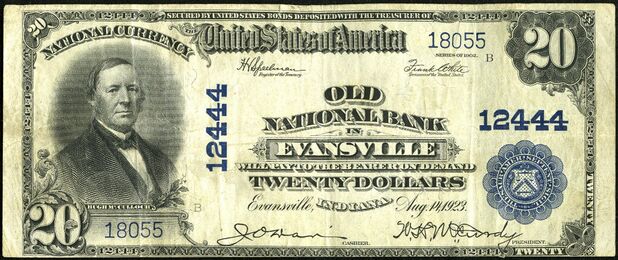

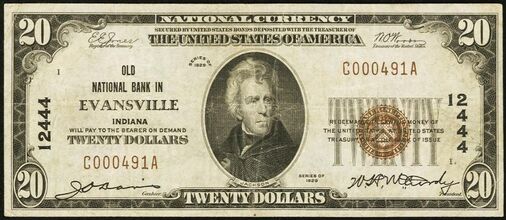

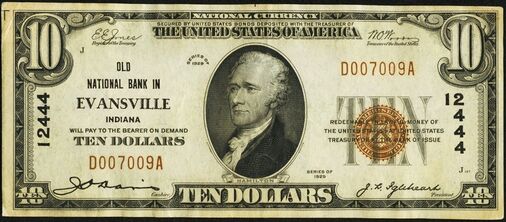

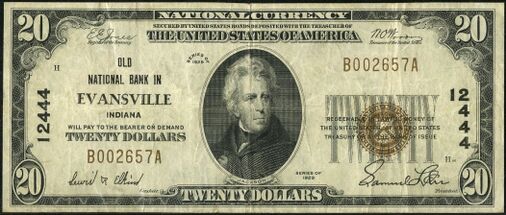

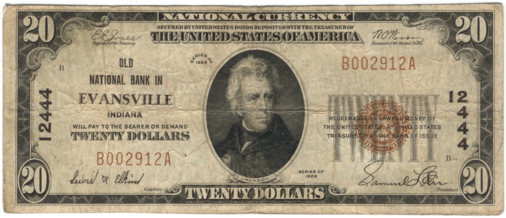

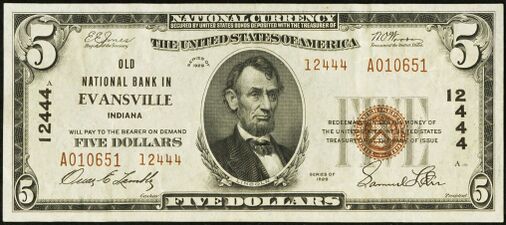

A total of $3,676,680 in National Bank Notes was issued by this bank between 1923 and 1935. This consisted of a total of 431,587 notes (243,360 large size and 188,227 small size notes).

This bank issued the following Types and Denominations of bank notes:

Series/Type Sheet/Denoms Serial#s Sheet Comments 1902 Plain Back 4x5 1 - 32405 1902 Plain Back 3x10-20 1 - 28435 1929 Type 1 6x5 1 - 12576 1929 Type 1 6x10 1 - 10428 1929 Type 1 6x20 1 - 2912 1929 Type 2 5 1 - 19328 1929 Type 2 10 1 - 11027 1929 Type 2 20 1 - 2376

Bank Presidents and Cashiers

Bank Presidents and Cashiers during the National Bank Note Era (1923 - 1935):

Presidents:

Cashiers:

Other Known Bank Note Signers

Bank Note History Links

Sources

- Evansville, IN, on Wikipedia

- Don C. Kelly, National Bank Notes, A Guide with Prices. 6th Edition (Oxford, OH: The Paper Money Institute, 2008).

- Dean Oakes and John Hickman, Standard Catalog of National Bank Notes. 2nd Edition (Iola, WI: Krause Publications, 1990).

- Banks & Bankers Historical Database (1782-1935), https://spmc.org/bank-note-history-project

- ↑ The Bankers' Magazine, Vol 94, Jan. - June 1917, p. 724.

- ↑ The Evansville Journal, Evansville, IN, Sun., Sep. 30, 1923.

- ↑ Evansville Press, Evansville, IN, Thu., Jan. 1, 1925.

- ↑ Evansville Courier and Press, Evansville, IN, Tue., Jan. 1, 1935.

- ↑ Evansville Courier and Press, Evansville, IN, Thu., June 28, 1923.

- ↑ Anderson Daily Bulletin, Anderson, IN, Sat., Sep. 29, 1923.

- ↑ Evansville Press, Evansville, IN, Mon., Oct. 1, 1923.

- ↑ The Evansville Journal, Evansville, IN, Sat., Sep. 29, 1923.

- ↑ The Evansville Journal, Evansville, IN, Sun., Oct. 2, 1927.

- ↑ Evansville Press, Evansville, IN, Wed., Feb. 6, 1935.

- ↑ Evansville Press, Evansville, IN, Wed., June 5, 1935.

- ↑ Evansville Courier and Press, Evansville, IN, Thu., Jan. 11, 1940.

- ↑ Evansville Courier and Press, Evansville, IN, Thu., July 29, 1948.

- ↑ Evansville Courier and Press, Evansville, IN, Sun., Aug. 27, 1950.

- ↑ Evansville Press, Evansville, IN, Sun., June 11, 1950.

- ↑ Evansville Courier and Press, Evansville, IN, Sun., Aug. 27, 1950.

- ↑ Evansville Press, Evansville, IN, Sun., Jan. 7, 1951.

- ↑ Evansville Press, Evansville, IN, Feb. 19, 1951.

- ↑ Evansville Courier and Press, Evansville, IN, Tue., Mar. 20, 1951.

- ↑ Evansville Press, Evansville, IN, Wed., Jan. 21, 1953.

- ↑ Evansville Courier and Press, Evansville, IN, Fri., Jan. 3, 1986.

- ↑ The Courier-Journal, Louisville, KY, Wed., Dec. 5, 1984.

- ↑ The Courier-Journal, Louisville, KY, Wed., Feb. 6, 1985.

- ↑ The Courier-Journal, Louisville, KY, Fri., June 14, 1985.

- ↑ The Indianapolis Star, Indianapolis, IN, Sun., Apr. 21, 1985.

- ↑ Evansville Courier and Press, Evansville, IN, Mon., Jan. 28, 1985.

- ↑ Evansville Courier and Press, Evansville, IN, Tue. Nov 5, 1985.

- ↑ The Warrick Enquirer, Boonville, IN, Fri., Nov. 15, 1985.

- ↑ Evansville Courier and Press, Evansville, IN, Fri., Jan. 10, 1986.